Banking in 2023: trends and challenges

Digital transformation continues to top the list of priorities in banking. However, the goal for 2023 is also to increase productivity and efficiency. Banks and financial institutions are also looking to digital solutions to help them to face increasing competition from FinTech’s and other innovative players.

As the new year gains speed, we look forward to the coming months and formulate expectations for the coming year. The obvious milestone is the launch of ISO 20022, but the banking landscape is more complex when it comes to digital banking transformation. What are the digital banking transformation priorities for 2023? What are the hindrances to a smooth transformation of the back office area, and as such, to improving service and enhancing the customer experience? The Financial Brand portal addressed these questions to experts in the banking industry. Here is what they had to say.

Digital maturity of banks: how far ahead are we?

Automating processes and implementing modern technology is an opportunity to move away from manual work and reduce operating costs. It helps maintain satisfactory margins, manage personnel and capital, and remain competitive in a demanding market. The industry wants to reduce costs and increase profitability with it.

The Financial Brand portal notes that financial institutions are making significant progress toward digital banking transformation. However, the level of maturity varies depending on the size of the entity, commitment to change and level of investment.

The top performers are the largest players. Moderate success has been recorded by the smallest banks and financial institutions, while most mid-sized companies ($10 – $100 billion) remain at the top.

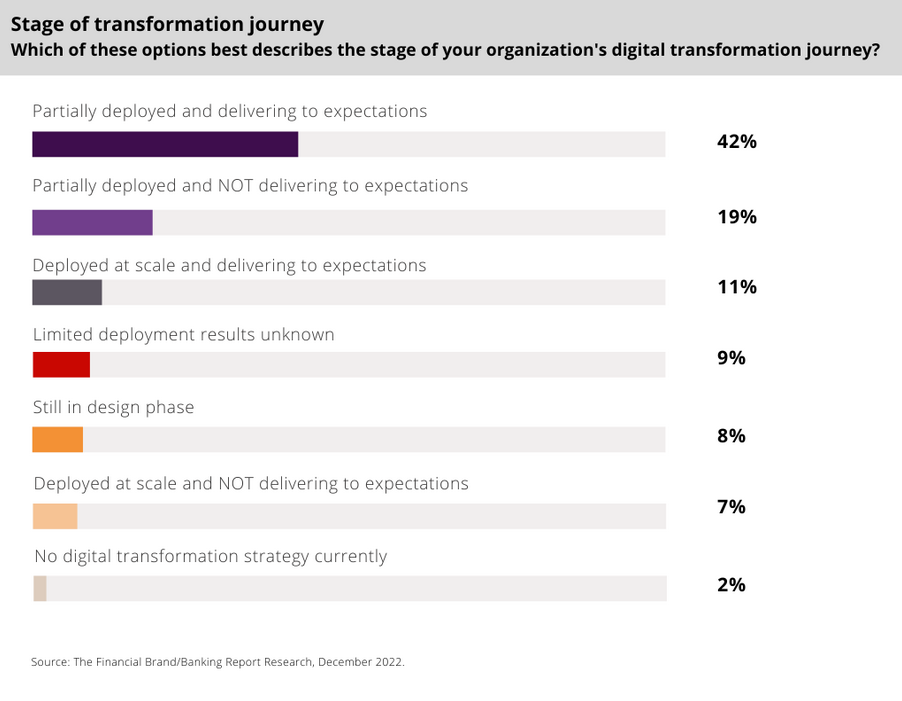

The Digital Banking Report portal has survey results on the level of sophistication of financial institutions in digital banking transformation. 18% of the surveyed entities said their solutions had been implemented at scale, while 61% said they had been partially implemented. Worryingly, 38% of organizations that believed they had implemented digital banking transformation solutions on a large scale did not achieve the expected results (a similar view was held by 31% of organizations with partial implementations).

In many cases, the lack of success was a consequence of not having a plan that specified the expected results. In some situations, however, the appropriate level of investment in the desired solution was lacking.

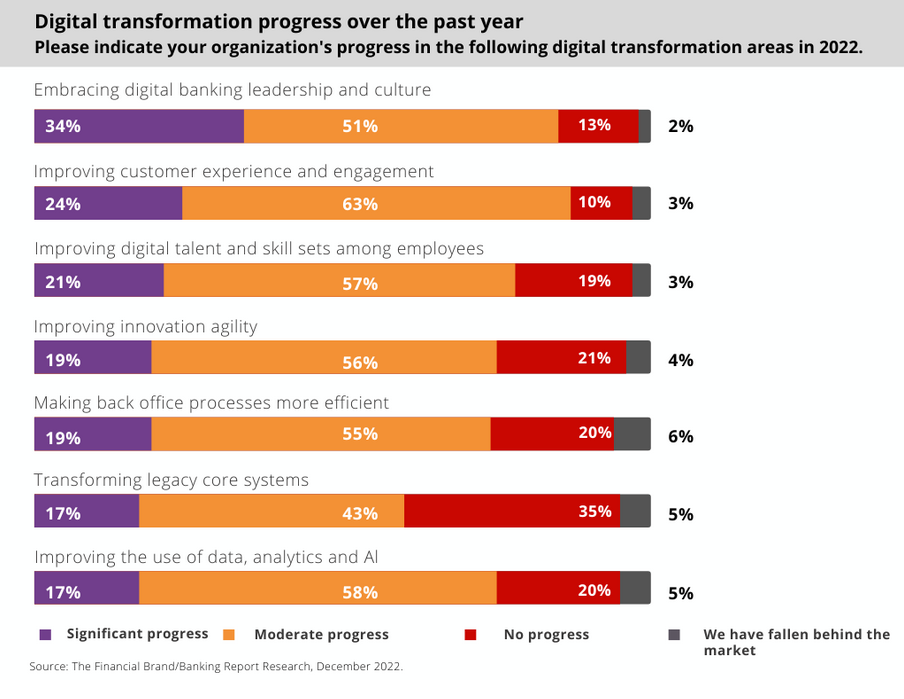

As the survey authors asked banking executives about progress in digital banking transformation over the past year, the greatest successes were reported in activities supporting leadership in digital transformation (34% of respondents felt progress was significant). The other area of significant progress was improving customer experience and engagement (as reported by 24% of respondents). Interestingly, the lowest level of progress was shown in the area of IT transformation (60% thought progress was moderate (43%) and significant (17%)).

On an optimistic note, although improvements in the use of data, analytics and artificial intelligence were below expectations, as many as 75% of entities said they had made moderate or significant progress in this area.

Additionally, improvements in net interest margins have significantly contributed to the financial performance of banks during their digital transformation efforts, further enhancing their return on equity (ROE) and overall profitability.

Digital banking transformation trends: what can we expect?

In digital transformation, 2023 will be marked by meeting customer expectations and increasing engagement in a secure environment. With more and more people using smartphones and other mobile devices, banks are focusing on building a mobile first strategy. They are optimizing offerings for mobile users: mobile payments and features to help manage finances on the go.

Another widely reported trend is the use of artificial intelligence (AI) and machine learning – still a major challenge for organizations. Institutions are investing in this area to increase cybersecurity and reduce fraud, but also with the goal of improving the accuracy and efficiency of operations. They also hope it will make it easier to personalize services to customers. Banks and financial organizations want to provide customers with product recommendations that facilitate comprehensive financial and budget management.

Embedded finance is another significant trend, reflecting how banking services are increasingly integrated into non-financial businesses’ operations. This integration allows consumers to access banking services more seamlessly amid rising competition from digital-first firms and tech giants.

See more at: Baas vs. Embedded Banking: who should control banking IT? (ccaeurope.pl)

Leaders of global financial institutions were asked to identify areas of digital banking transformation that will be extremely or very important in the next three to five years. Cyber security (96%), mobile experience (91%), mobile channels (87%) and data and analytics (83%) were mentioned first. With more and more financial transactions taking place online, banks are devoting more attention and energy to data security and protecting customers from cyber threats. Financial institutions are investing in advanced security technologies, such as encryption and biometric authentication, to keep customer data safe.

Another area of focus is open banking. In an open banking environment, it is easier for institutions to offer more innovative products and services to customers, and to compete more effectively with FinTech’s and other innovative players.

Challenges on the horizon

DBR survey reveals key challenges for financial institutions as they embark on digital banking transformation:

Resistance to change. The digital transformation of banking implies far-reaching changes in the functioning of the organization, which managers and employees must navigate. The survey and interviews conducted for the Banking Transformed podcast unequivocally indicated that the challenge will be to engage all staff in the changes.

Limited resources. Allocating the necessary resources to support digital transformation initiatives can prove problematic, especially in times of economic uncertainty. Difficulties are no doubt compounded by the scale of investment in technology or training.

Complexity: outdated systems are often legacies of past business strategies. They are difficult to integrate with newer digital technologies, which can hinder the implementation of new digital solutions. Staged integrations are sometimes a way out, but these create additional complications.

Data security concerns: concerns about privacy and information security are growing along with the volume of data being processed. Ensuring their security is a necessity, but also a challenge that accompanies the next steps organizations take when implementing new digital technologies.

Compliance: financial institutions operate in a maze of regulations and ever-changing rules. The implementation of new technologies in the digital transformation of banking only compounds the difficulties in this episode.

In light of the challenges, financial institutions must act strategically and take initiative. Transforming the internal and external operations environment through the use of modern digital technologies requires proper diagnosis and thoughtful action.

Regional banks face additional challenges due to high inflation and the collapse of several major regional banks, leading to significant consumer deposit outflows. These pressures have intensified the competition for deposit growth, prompting banks to focus on enhancing customer experiences to retain and attract deposits amidst a changing financial landscape.

Business models under scrutiny

Automation of processes and implementation of modern technologies is an opportunity to move away from manual work and reduce operating costs. It will help maintain satisfactory margins, manage personnel and capital, and remain competitive in a demanding market. The industry wants to reduce costs and increase profitability with it.

The digital banking transformation is forcing a change in the business model. The goal is to keep pace with the competition. A survey of financial institutions around the world revealed a clear decline in the number of organizations convinced that they will be a universal player in seven years (42% are betting that they will be so in 2030 – 60% currently see it that way).

Another big change is the expected increase in the number of open platform players (from 8% to 26% of financial institutions in 2030). Such an environment offers opportunities for banks and financial institutions to diversify their product offerings: they can expand their portfolio of financial products and services to include wealth management and investment services, or open up to new customer segments.

Minor modifications to functioning business models are also to be expected. The share of financial transactions carried out digitally is growing, so banks and financial institutions can monetize their digital know-how in mobile banking, online account opening or digital payment options.

Customer at the center of attention

The results of the survey show that customer experience will be a priority. It will be the basis for the evolution of business models in the near future. Financial institutions will ensure a positive customer experience by offering personalized services, adding value, simplifying distribution and using technology. Banking is expected to be more convenient and efficient.

Not for the first time, the key to a successful change in the banking business model is proving to be keeping a close eye on the changing needs and preferences of customers. As always, it is also worthwhile to be open to testing new opportunities and technologies that can help you stay competitive. And don’t get left behind. The only sure thing is change.