ISO 20022 enhanced data: who will pave the way for new opportunities?

Financial institutions are racing against time to launch the basic functionalities of ISO 20022 before March 2023. However, everyone is looking to the benefits that rich data in business is supposed to bring. For now, however, there are no daredevils who would state exactly what can be done and how, to ensure the consistency of the ISO standard.

To say that the world of banking lives and breathes ISO 20022 sounds like an understatement. Taking into account the geographical and substantive scope of implementation, the new standard is an industry revolution. In the world of finance, it will affect not only the area of payments, but also card transactions, currency exchange, securities trading, and trading services.

Following the pandemic-related turmoil, the implementation deadline was postponed from November 2022 to March 2023. Even during the three-year transition period for MT and MX, the first beneficiaries of ISO 20022 could leverage richer, structured data. Many institutions are rubbing their hands at the thought of raising the standards of preventing financial crime or money laundering, or increasing compliance. But the implementation of ISO 20022 also has its dark side.

Adapting the financial market infrastructures to the new standard involves a number of challenges. Banks must clearly define a long-term migration strategy and perform a comprehensive impact assessment. The testing phase is also a major challenge. The number of cases that financial institutions will have to anticipate and run in order to avoid the negative impact of the transition to ISO 20022 on customers and operations (especially cross border payments) is huge.

Put simply, ISO 20022 implementation of is a much more complex operation than any regulatory projects implemented in the last 10 years, including SEPA. The scope of required changes could involve, on average, up to two or three years of work and the participation of multiple IT teams.

Financial institutions can turn a forced revolution into an advantage

With the implementation of ISO 20022, financial institutions are experiencing a technological leap. It can change not only the standard of customer service, but also the perception of the entire payments industry and broaden its development prospects. Effective implementation of individual elements of ISO 20022 could turn out to be a proactive move against the constant pressure of fintechs popping up like mushrooms.

A brief look at industry news shows that banks have hit the wall in terms of data processing as their payments systems and applications have reached their limits (according to Capgemini, as many as 75% of bank directors believe so! [Capgemini, 2020]). Global players of the payments industry will certainly appreciate the standardization, which will make it easier to navigate the seas of various legal regulations, especially with relation to high value payments. Payment service providers will benefit from improved data quality and enhanced compliance capabilities, allowing them to innovate and compete more effectively. Clear and legible data packages and their compatibility between the systems of banks, supervisory institutions, and customers will, in turn, allow to increase the degree of automation of payments processing.

The world is waiting for faster transfers

Bankers from all over the world keep tabs on any possible changes in the area of transfers, and rightly so. Not only is the amount of data used in this banking operation limited, but it is a source of problems for many professionals. Banking staff spend a lot of time manually processing complaints and explaining discrepancies in transfer data, especially cross border payments. SWIFT estimates that up to 10% of cross-border payments are delayed at some stage due to additional checks, the vast majority of which are false positives!

Meanwhile, ISO 20022 enforces more structured data, which means fewer mistakes and faster processing. This will certainly be appreciated by not only employees but also customers. Improved straight-through processing (STP) plays a crucial role in harnessing the advantages of ISO 20022 enhanced data for payments, leading to reduced processing costs and greater operational efficiency. A report by the Committee on Payments and Market Infrastructures (CPMI) published in May 2022 clearly indicates market expectations towards banks: transaction costs must be reduced and transactions processed faster. In turn, a study carried out by the Boston Consulting Group revealed that corporate banking must offer the same experience as personal banking (as stated by 95% of the representatives of 650 companies surveyed).

Structured data heralds better competition

Structured remittance data plays a crucial role in this evolution, enhancing transaction processing efficiency and improving reconciliation practices.

In the world of generational change and innovative solutions, consumers appreciate personalization. Deutsche Bank report ISO 20022: How companies and banks can benefit indicates that banks that diligently prepare for the implementation of the new standard can increase their competitiveness.

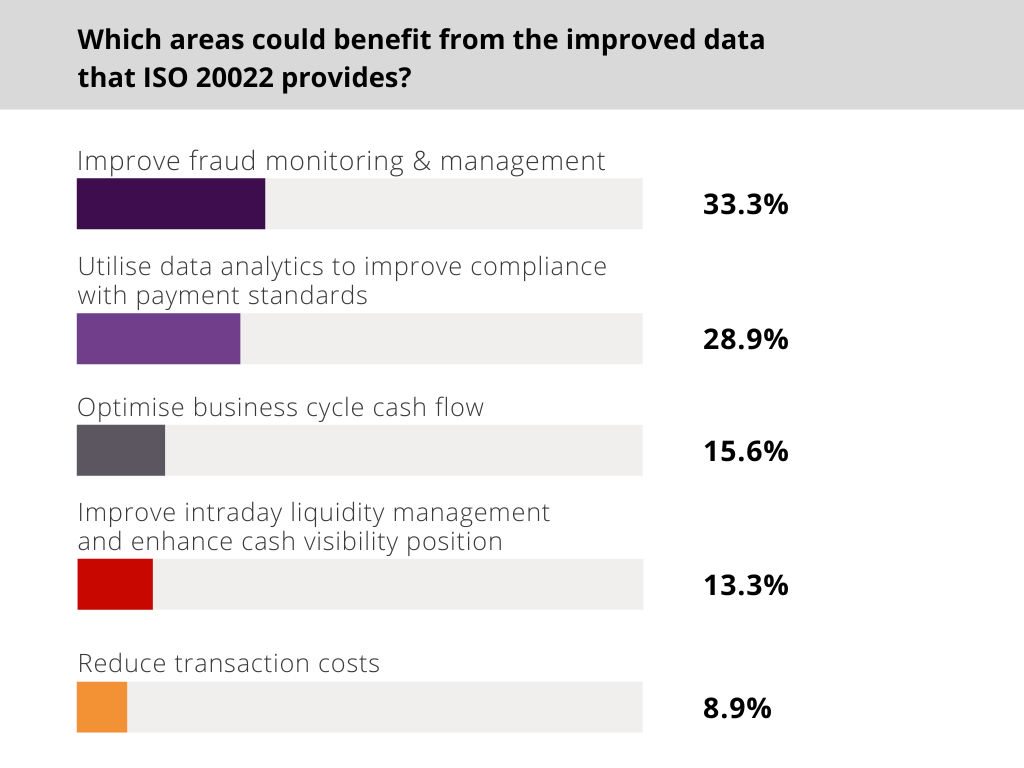

Every third survey participant indicated that the new standard would improve the ability to monitor and manage fraud. Almost 30% of the respondents believed that ISO 20022 will bring new opportunities in the analysis of data necessary in the area of compliance. The benefits also included optimization of cash flows (15.6%), improvement of liquidity (13.3%), and reduction of transaction costs (8.9%).

The issue of ongoing generational change is also important for banks (Gen Z is already joining the ranks of bank employees!). Employees do not understand the need to perform tasks manually and do not understand why they should do it. They know that such activities can be automated and will demand it. Accelerating transactions and the ability to personalize services using augmented data is the right direction if banks want to attract the best staff.

The EY example: combining the worlds of banking and insurance

The new standard of data processing gives hope that we will finally enjoy bank transfers. In How to unlock the power of enhanced data post ISO 20022? the consulting company EY pointed out an interesting direction. Could there be an application or functionality that will skillfully combine payments data with insurance claim information in the insurer’s system?

For example, an insurance company that processes claims from a large fleet client must handle data from dozens of vehicles that travel throughout Europe. Claims concern damage to property, infrastructure, and personal injury in several countries, and several entities are involved in processing them. Each case has several reference numbers. With a limited data structure, matching payments and arranging transfers is a real challenge.

This is where a great opportunity for financial institutions arises: data structuring with transparency and repeatability of transfers in mind. Introducing the option of filtering payments by the country of the event or the perpetrator’s vehicle number would immediately be appreciated by the clients, through their wallets. They simply cannot wait for it!

Defining ‘critical payments’ within the context of operational resilience is essential. The ISO 20022 messaging standard provides a more effective means for Payment Service Providers (PSPs) to identify these critical payments, suggesting that a standardized approach to Purpose Codes is crucial for accurately mapping and recognizing critical payments in the retail payments sector.

Communication standard is not synonymous with content standard

Bankers emphasize that the revolution does not come as a surprise to them, and it will only increase their competitiveness. They are diligently preparing for the new standard with full conviction and faith that enhancing data, accelerating transactions, and increasing personalization of services is the right direction of change. However, so far there are no concrete business proposals for the actual use of the new format (SWIFT MX).

The problem is that the new standard of communication in payments is very flexible. Basic transfer data have their fixed position in the MX form, but where to put additional data (that is, the Holy Grail of the banking world) is not so clear.

Another problem is that ISO introduces a communication standard, but does not introduce a content standard. So far, no one has ventured to propose specific types of data, or rather entire documents that could be attached to the basic transfer message. There was no proposal even for industry variations of the standard, e.g. for insurance companies. Suppose that one institution attaches an invoice file to their transfer, another a product specification, and the other one a marketing brochure. Is standardization of communication even possible when various “dialects” of the standard start to emerge?

Who will be the first to use the rich data stream?

For the time being, there is no strong voice in banking that would propose even a framework for using rich data. SWIFT could play that role, or an international industry consortium, e.g. of large telecommunications or insurance companies. These organizations could agree on what and how can be sent, and what not, to maintain order in data exchange according to ISO 20022.

Perhaps from March 2023, when most financial institutions in Europe will start using the basic features of the MX format, a real race to leverage the potential of ISO 20022 will begin. It will be interesting to see who will speak up first and what the scope of using enhanced data will look like in practice. Feel welcome to engage in a discussion with our CEO, Jacek Nowak, on LinkedIn.