MT/MX converter: parlez vous ISO 20022?

MX – the new “language” for cross-border payments – enters into force in November 2022. Which SWIFT XML broker will ensure smooth communication in global banking after the launch of ISO 20022?

The history of cross-border payments began with… cooperation with the media. From the 1970s until the beginning of digital banking, banks used long-distance telegraphs from the Reuters news agency for cross-border transfers. This solution was adopted by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to settle payment orders on correspondent accounts of individual institutions.

In the times of fledgling digitalization, data used to identify the transfer was sent by telex, in the then-accepted text format MT, which was organized like a telex form. One field represented one piece of information and was expressed with a number instead of a word. For example, 13C is a time stamp and 26T is a transaction type. One transfer required a total of several dozen “fields to be filled”, i.e., transfer information to be provided. As a result, the received message could be deciphered into all languages.

Goodbye SWIFT MT, welcome SWIFT MX

The main MT message format used for interbank clearing by SWIFT has not changed since the 1970s, however, the tools used to process it have as the message has been expanded over time. One such improvement was the introduction of an additional SWIFT code to identify the financial institution in the international banking pool. That’s how the bank’s “address” was born, the BIC (Bank Identifier Code), which is the ID of the financial institution in the SWIFT system.

Over time, several fully digital standards for transferring transactions have emerged besides SWIFT: TARGET2, SEPA Credit Transfer, or TIPS. However, all of them have a smaller range than those based on the MT SWIFT message. Although banks today have the technical capacity to send large volumes of transactions instantaneously, one of the bottlenecks that prevents this is the MT message type.

No wonder then that the banking world has decided to introduce a new and more universal language for international transactions. From November 2022, a new format for cross-border transfers, MX, enters into force. It is the successor of the MT format, but adapted to the capabilities and expectations of Data-Driven Banking. Based on the XML structure, the MX messaging type enables easy data exchange in a common, flexible standard.

MT/MX conversion: the quest for context

By creating a common “language” and model for payment data, ISO 20022 significantly improves the transparency and efficiency of transactions. In addition, richer and structured data will open up new possibilities for personalization and improvement of the bank’s customer experience. However, the introduction of a new communication standard is fraught with considerable difficulties.

First of all, there is no common “dictionary” that would allow direct translation between different message formats. While the conversion from “new” to “old” format (MX to MT) is relatively simple, from “old” to “new” (MT to MX) it requires advanced knowledge of the relationships between individual message elements.

The “new” message (MX) has a multi-level, organized structure, which allows elements to be aggregated and correctly assigned to the “old” MT format easily and unambiguously. On the other hand, the data clusters in the “old” MT format do not always have clear rules for interpreting (“unpacking”). Meanwhile, the system that converts the message must “know” how to break down each incoming information into single components, and then properly recreate it in the default format so as not to lose any information and certainly not to generate an error.

Example:

Bank (BIC: EXABNL2U) from Utrecht, The Netherlands, received a transfer order from his client ACME NV (Amstel 344, Amsterdam) to transfer 12,500USD on October 29, 2019 from the account no. 8754219990.

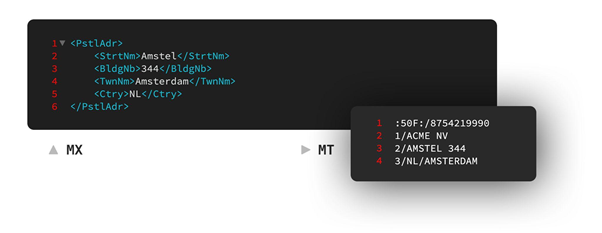

In the “new” MX message (see below left), each value is contained in a separate element that has a unique label to identify and interpret its value. In the “old” MT format (right), the same values are much more difficult to interpret.

These translational difficulties are best seen in two elements:

1. Amount, currency, and date of the transaction:

The illegibility of the MT message is obvious. Two-way translation can only be done with clear conversion rules.

2. The address of the ordering party:

In the MT message, all ordering party data is under a single label (50F:) with the account number, whereas the address is divided into consecutive lines (1/, 2/, 3/) with no differentiation into the name of the city, street or country.

If the address is typical and the elements are not too long, the address will read as shown in the illustration (1/company name, 2/street and number, 3/country/city). However, if the company name is longer than 33 characters, then line 2/will not contain the street and number, but will continue the name of the company. On the other hand, if the address also includes the name of the state/province, address line 3 will not hold all the information, and perhaps an extra line 4 will be added.

As you can see, assembling the address in line 50F: is simple in the case of the MX message, but the reverse conversion requires knowledge of the context. For example, knowing that there are four lines and a European country (BIC address!), we can expect a “classic” address and a long customer name (lines 1 and 2). However, if the address is US-based, the last line must be interpreted as a country/state/city.

These examples show that the translation of MT/MX messages can be very complicated in some cases. It is like looking for an address in a foreign city. As long as the street names and numbering are standard, you will easily reach your destination. However, with a non-standard address, it is easy to get lost. Without a thorough understanding of the anatomy and context of the message, i.e., different naming and numbering methods, the banking system can also get lost in MT/MX translation.

When preparing to launch an ISO 20022 SWIFT MT to MX converter, it will be difficult for a developer to know how to relate the old and the new message formats for a glitch-free exchange. In-depth knowledge of the banking process and its intricacies is the area of expertise of the banking system analyst. Their domain knowledge allows for scrupulous analysis of the scope of tasks ahead and preparation of implementation guidelines for developers. My colleagues discuss the benefits of working with banking IT analysts in the article “ISO 20022 migration: how to avoid the testing cost spiral?”.

MT/MX converter: more than a temporary solution?

Once the changes required in the new communication standard have been mapped, it is time to select a strategy for their implementation. The bank can add a ready-made ISO 20022-compliant interface to its core system, or develop its own solution. There is also a third approach: a SWIFT MT/MX format message converter. Some organizations choose it as a temporary solution due to time limits or budget. On the other hand, some choose the solution that not only solves the immediate problem but is also future-proof and meets long-term development strategy goals.

Translators supporting data validation, enhancement, and conversion between different standards or formats are already becoming available. One of them is the native SWIFT MT/MX converter. This solution will certainly be used by large international organizations. However, its complexity, as well as the costs of implementation and maintenance, do not make it a good fit for every organization. Organizations that need an optimized MT/MX converter can use the independent MT/MX broker that is a business application integrated with the core system. A good example of such a solution is our proprietary system, Payres.

MT/MX converter: light solution, great possibilities

As an ISO 20022 converter, Payres enables the settlement of SWIFT XML ISO 20022-compliant international payments. As a “lightweight” Java-based MT/MX message broker, Payres eliminates the need to modernize core systems and maintain the efficiency and flexibility of the banking architecture. The solution is cost-effective and does not require a complicated implementation process. Payres works in Real-Time Transform (RTT) flow, and the support of the Drools rules engine minimizes the inevitable delay resulting from the serial position of the translator in the payment message path.

Payres works with back-office applications that do not support the new format, or do so only partially. Our message broker automates transaction processing between back-office applications and external networks.

However, unlike “classic” MT/MX converters, Payres processes data in real-time, automatically leveraging the data flowing between the bank’s core system and the integrated applications. Payres is suitable even for organizations that plan to ultimately implement MX messaging in the core system itself! When it is no longer needed as a MT/MX converter, it can support real-time data activation in the spirit of Data-Driven Banking.

Breakthrough changes go well with long-term perspective

The temporary converter is a perfect solution to maintain communication in the global banking world after the launch of the “new” communication standard in March 2023. However, banks that make do with a temporary MT/MX translator and neglect to thoroughly modernize their IT architecture will have to make extra effort to catch up.

With the scope of technical requirements for the new standard, and the multitude of markets and areas where change is taking place, banks are jostling for specialists. For more, read our blog post on ISO readiness in UK.

With the “banking Esperanto” of ISO 20022 at your disposal, you not only gain a universal language in which to communicate, but also new business opportunities (read more on our blog where we discuss the possibilities of ISO 20022 enhanced data).

Need support in migrating to ISO 20022? We are a team of professionals with experience in advanced payment processing projects, e.g., card payment messages for international clients, and we can help you make that transition. Contact us!

Download our free e-book “ISO 20022: the new standard in a complex environment” and see how our proprietary solution, Payres, supports migration to ISO 20022 and the future-proofing of data.