Case studies ![]() Credit Agricole Bank Polska

Credit Agricole Bank Polska

Case study: functional and regression tests in the Customer Interaction Platform

Our proprietary application PATT supports functional and regression testing in the Event-Driven Banking (EDB) solution for real-time customer relationship management.

BUSINESS PARTNER

Credit Agricole Bank Poland is part of the world’s largest and most stable financial groups, Credit Agricole Group. The Group has been present in Poland since 2001, when it acquired 75% of LUKAS Bank’s shares. The company employs over 4,500 employees.

THE CHALLENGE

As a long-term business partner of the bank, the CCA Europe team was invited to an EDB architecture project in the Retail segment. The aim of the project was to use messages and events in the Profile core system to manage interactions with customers in real time.

CCA Europe was requested to test the application as part of the bank’s proprietary solution, the Customer Interaction Platform (CIP). The role of the tested application – Event Processing Platform (EPP) – is to convert operational messages from the Profile central system. Upon receiving the message, EPP identifies it and processes it in real time, using the appropriate business rules. Then, EPP sends an appropriate message to the next application, Unica, which sends tailored information about the offer or service to the client in real (or near-real) time (the right moment, and the right product, with the right communication channel).

The first stage of the project included functional and regression tests of message detection in the Profile system and generating events based on predefined operations.

The following messages were tested:

- Balance Drop

- Large Transfer

- Transaction Rejected

- High Withdrawal

All messages intercepted in the source system were to be archived and then verified in terms of correctness of the defined attributes.

THE SOLUTION

The functional testing assignment included defining test cases based on the submitted documentation, running functional tests and retests, and then preparing a report and transferring knowledge in the form of a workshop.

Due to the change in the area of authorization and accounting of card transactions, regression tests were carried out for six business areas, including card operations and MoneySend/VisaDirect transactions.

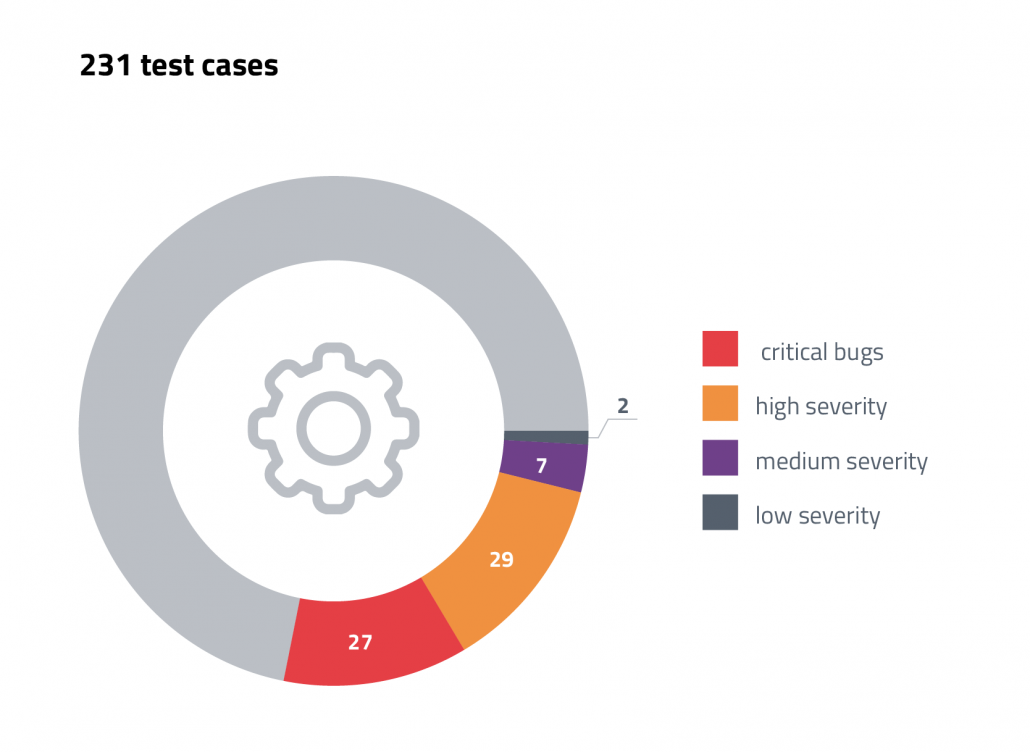

Of the 231 test cases executed, 27 critical bugs were reported, 29 with high severity, 7 medium, and 2 low.

A very important element of the testing process was to correlate events over time, taking into account time windows. It was also critical to run performance tests to determine whether the EPP allows for efficient reading of messages from the input queue and whether the message processing time is within the set limits.

During the simulation of card transactions, we used Profile Automated Testing Tool (PATT), a proprietary platform for creating, running, and managing automated tests, supporting Profile and other non-browser systems. PATT has proven itself as a generator of mass card transactions, simulating communication between ATM/POS and the core banking system.

The project lasted five months; CCA supplied a Project Manager, Test Master, and three manual testers with various specializations: domestic and foreign payments, card debit, and credit payments as well as system parameterization and credit account servicing.

In the subsequent phases of the project, to expand the scope of events and messages supported by the CIP platform, the bank plans to implement and test the following functionalities:

- Outgoing transfer – elixir, or debit in a transactional account with a specific payment system (ELIXIR, EXPRESS ELIXIR, INTERBRANCH, INTERNAL, SEPA, SORBNET, SWIFT);

- MCC Codes – debiting a credit card or transactional account with card operations that have selected MCC codes;

- PSD2 – sending an AIS request to the bank to check the customer’s account and to execute transactions on it.