Cypress vs. Selenium: which is best for testing chatbots?

Trendy

The speed and agility of Cypress, or the advanced capabilities of Selenium WebDriver? Our tester, Mateusz, shares what counts more in testing conversational marketing chatbots

This post discusses:

how to prepare a test automation tool…

Banking application tests: in the golden triangle of domain knowledge

Data Driven Banking

In specialized tests, the point is not to "click through" the application, but to ensure the correct flow of the entire process. This is where domain knowledge comes in handy.

George E.P. Box, dubbed "one of the greatest statistical minds…

Payres: deadline buffer for CHAPS ISO 20022 migration

ISO 20022

With smart solutions in place, you can reroute your timeline for the ISO 20022 new messaging standard by June 2022. What's more, your CHAPS ISO 20022 transition project can be leveraged to win market advantage.

Clearing House Automated Payment…

NPA ISO 20022: the game is afoot!

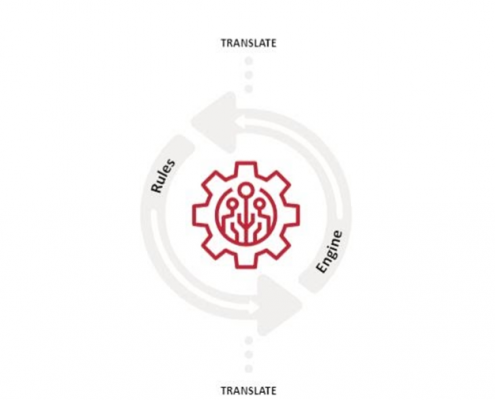

ISO 20022Pay.UK’s technical documentation for ISO 20022 implementation heralds serious technical changes for UK payments. For those who need a time shield for ISO migration, we recommend using a flexible solution: a converter.

The introduction of…

Pan-European instant payments: is TIPS worth the while?

Payments

In developed countries, instant payment settlement has moved on from “nice to have” to “must have”. There is practically nothing that would prevent an international instant transfer settlement system, except that building one is a demanding…

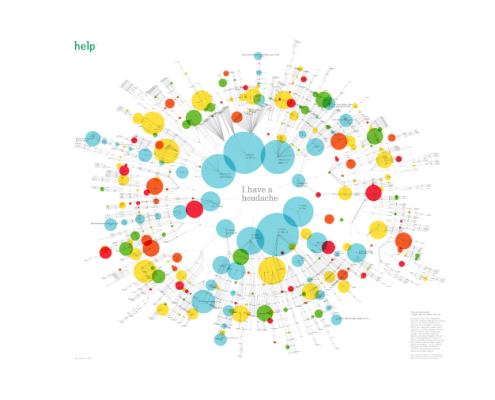

Seeing is believing: making the visual a part of your data culture

Data Processing

In the era of ever-increasing data volume, the importance of efficiently communicating it is growing. And that’s where data visualization steps in. As banks use an increasing volume of data, proper visualization will allow its best possible…

Data-driven culture in banking

Data Driven Banking

Banks collect and process vast amounts of data, yet few approach it as if it were the most valuable of their assets! In fact, it is fair to say that when it comes to extracting relevant and useful business insights from their data, financial…

5 reasons why you need real time banking

Data Driven Banking

Going real time means benefits as well as challenges. See how banks can navigate the transition using a gradual approach and tools like Payres.

When it comes to the banking client, the leniency margin is decreasing. Customers treat their…